Maximising your savings, minimising your stress

18th Sep 2023

Abbie

It’s UK Savings Week! 💸 According to Finder, around 11.5 million people in the UK have less than £100 to fall back on in the event of an emergency with almost a quarter of Brits (23%) not having any savings at all. The aim of UK Savings Week is to raise awareness of the benefits of saving, and to help everyone to save if they can, regardless of status or situation. This annual event is a great opportunity to take a closer look at your financial goals and find ways to boost your savings! 💪

Whether you're saving for a rainy day, a dream holiday, retirement, or simply as a ‘just in case’, this week is all about helping you make the most of your hard-earned money. In this blog, we'll explore some essential tips and strategies to help you maximise your savings during UK Savings Week and beyond…☁️

Set clear financial goals 🌟

For those who haven’t saved before or aren’t quite sure where to start, starting to save can be overwhelming, so baby steps! The first step in building your savings could be just setting a few, clear financial goals. Ask yourself what you're saving for. Is it an emergency fund, a new home, a gift, a comfy retirement, or something else? Defining your goals will give you a target to work towards and help you to stay motivated and consistent.

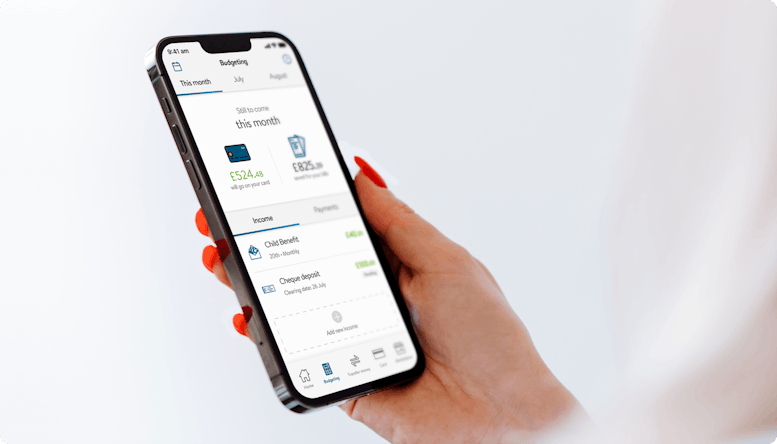

Create a budget 💰

Start seeing your budget as your financial roadmap 🛣️ It allows you to track your income and expenses giving you have a clear picture of your finances. Start by making a list of all your monthly expenses, including bills, food shopping, entertainment, and savings. If you can, dedicate a portion of your income to savings, whether it’s £2 or £200, and stick to your budget as closely as you possibly can.

If you struggle with sticking to your budget, a great way to limit yourself is to draw out your budget amount in cash to avoid careless spending. If you prefer having something you can refer back to at any moment,Canva has some fantastic and fun (yes,really!) budgeting templates you can use for free, or you could use a good ol’ notepad.

Automate your savings 🤖

One of the easiest and temptation-free ways to save is by setting up automated transfers. When your paycheck arrives, have a portion of it automatically transferred to your savings account. This "pay yourself first" approach ensures you're consistently saving without even thinking or worrying about it.

Evaluate your current account 🏦

Your current account can actually help you on your savings journey. Does your savings account help you to budget and split your spending money from your expenses, to help you keep track and reach those goals sooner? thinkmoney’s does 😉 (just saying).

Reduce unnecessary expenses 💅🍕

This is the one that everyone dreads, because ‘unnecessary expenses’ are usually the things we love the most, but it has to be done in order to achieve your savings goals. Having access to the things we love is important, but there are always areas we can pull back.

Do you really need that Starbucks every morning? Do you really need yet another gadget? Do you absolutely need a takeaway or could you cook tonight? Are there subscriptions or memberships you no longer use? Can you find more affordable alternatives for daily expenses?

Take a critical look at your spending habits and identify areas where you can cut back. Every pound or penny saved can be directed straight towards your savings goals (it will be worth it).

Eliminate debt 🙅

Debt is also a force to be reckoned with and can hold you back massively in achieving your savings goals. High-interest debt can be a significant drain on your finances. Prioritise paying off credit card balances and loans as quickly as you can. Once you're debt-free, redirect the money you were putting toward debt payments into your savings 💷. You could also pay half to your debts and half to your savings, if this method works better for you!

There are many support systems that can help you if debt is becoming too overwhelming - Citizens Advice Bureau, National Debtline, Moneyhelper, Step Change, and other mental health organisations are just a few examples of networks that are hands on and available to help if needed.

Take advantage of employer benefits 🤩

If your employer offers a retirement savings plan like a workplace pension, make sure you're taking full advantage of it. These plans often come with employer contributions, which can significantly boost your retirement savings! Check your contract or speak with your HR rep to see if this benefit is available to you.

Regularly review and adjust 🧐

Your financial situation and goals are likely to change or shift over time. It's essential to regularly review your budget and savings plan to ensure they align with your current objectives and where you’re at. Make sure you celebrate each goal, even if it is just sticking to your budget each week - small wins are still wins 🏆 Make adjustments as needed to stay on track.

Summary

UK Savings Week is a fantastic opportunity to jumpstart your savings journey. By setting clear goals, creating a budget, automating your savings, and exploring various financial tools, you can maximise your savings potential. Remember that consistency, discipline, and always celebrating the small wins are key to building a secure financial future. Start today, and build a better tomorrow ❤️

< Back to articles